Saving money is an essential yet often tricky financial task for many people – even those with a relatively high income.

An article by Yahoo! Finance reported that only 58% of Americans could even afford to pay for a $1,000 emergency in cash. A 2018 article by CNN Markets found that only 28% of Americans have 6 months worth of expenses saved.

No matter what your annual salary, many like you are wondering how to save money each month, so you don’t find yourself without savings when you need it most.

4 Tips For How To Save Money From Salary

Keep reading to discover how to save money from your salary, whether you earn $25,000 or $125,000 per year.

1. Know Your Why

Before reviewing different ways to save money, you want to first determine your reason for saving. Do you want to fund your $1,000 emergency savings? Are you working on your 6-month savings account? Are you saving for holiday and birthday gifts ahead of time? Know what your ultimate savings goal is and set smaller benchmarks to help you get there.

You can establish your why in advance, but it’ll be easier to set your benchmarks after you go through the steps listed below.

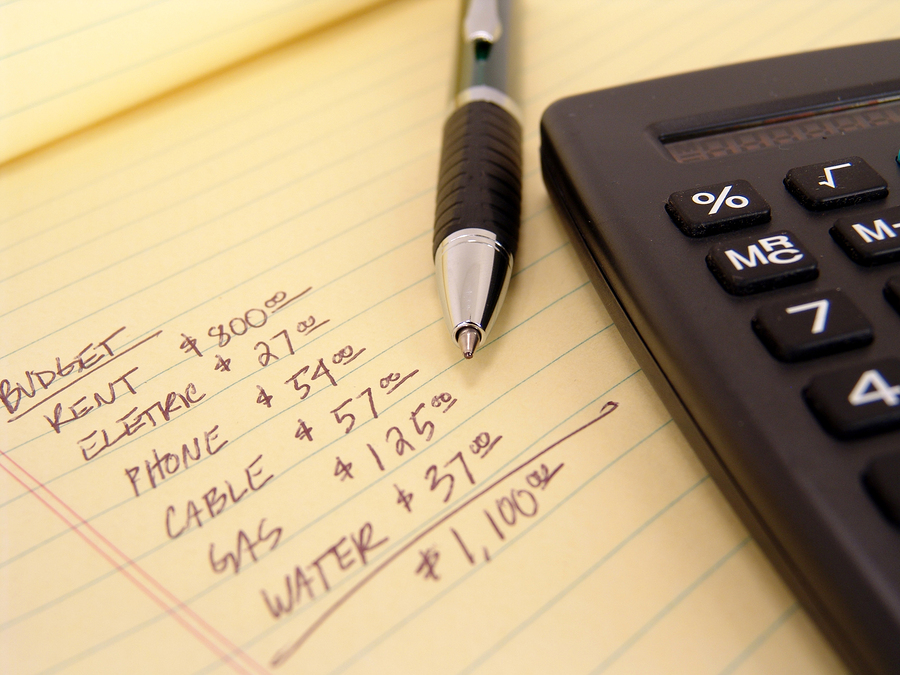

2. Set Your budget

If you want to save money, you have to spend less than you earn. You’re more likely to be successful when a solid plan is in place.

The first thing you want to do is set a budget. While having a budget often comes with a negative connotation, it’s better to think of it as telling your money where to go instead of allowing it to call the shots in your life.

List out everything you spend money on including your fixed expenses, semi-fixed expenses, and variable expenses. Fixed expenses are those that are unlikely to change, such as your rent or health insurance premiums. Your semi-fixed expenses can vary based on different factors. For example, if you take shorter showers, your water bill will likely decrease. You have the most flexibility with variable expenses. These include your food or entertainment budgets.

After you track your expenses, determine what your budget is on each category. You can do this by reviewing the last 6-12 months of your account statements and finding the average amount spent for each category.

Be sure you set a realistic budget that you’re likely to stick to. Once this is done, compare your expenses and income to track the difference between the two. This is the bare minimum that you can save each month.

3. Reduce Spending & Save More

Next, review your budget to determine where you can reduce spending.

This can be more difficult for the fixed category expenses. You might be able to move to a cheaper apartment or refinance your mortgage or auto loan to reduce those fixed expenses. It’s best to look at your current financial situation to determine the best option for you.

In your semi-fixed category, you might be able to save some.

For example, reduce your cable bill by cutting the cord or eliminate some of your unnecessary cell phone services. Even if you can save $10 or $15, every little bit counts and it adds up.

You will more than likely be able to save the most in the variable expenses category. Food is often one of the most significant expenses that can be eliminated. Think about how you can make less expensive food choices, reduce how much you go out to eat, etc.

For clothing, don’t be afraid to shop second hand or sales racks. For entertainment think about less costly, or even free, activities to do around town to further reduce spending in those categories.

Another tip is to use cash or open a checking account specifically for your variable expenses. That way, once you’ve spent all of your money in those categories, you won’t be able to overspend as easily.

Review your budget after you’ve figured out where you can cut your expenses to see how much you are now able to save each month.

4. Make More Money

Once you’ve cut your expenses to increase your savings, you can determine if you need to make extra money to reach your savings goals. Now is the time to review your savings goal and set the benchmarks to get there.

For example, if you want to save $5,000 in the next 12 months, you’ll need to put aside $416 per month. If you can only afford to save $250 per month based on your budget, you might want to see how you can make up that extra $166.

Consider increasing your hours at work, taking on additional projects, starting a side business, or even looking for a job that pays more overall.

The alternative to making more money would be adjusting your savings goal to match your current budget.

Planning For How to Save Money Each Month

While the act of saving can feel complicated, it’s quite a simple idea. If you spend less than you earn, you will have money to save each month. This is when it’s time to put your commitment to play, review your finances, adjust your budget, and make more money if need be to reach your savings goals.

At Belco Community Credit Union, we offer a variety of savings account options so you can safely store your money while on your saving journey.