What Is a Budget?

A budget is a simple yet powerful financial tool that helps you manage how you save and spend your money each month. Simply put, a budget helps you take control of your money instead of wondering where it went.

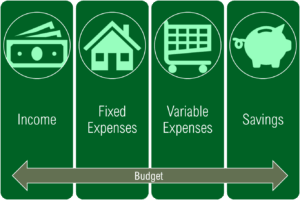

When you create a budget, you can clearly see:

- How much money you bring in (your income)

- Where your money goes (your expenses)

Once everything is laid out, you may begin to spot areas where you can cut back, reallocate your spending, or start saving more intentionally. According to Debt.com’s 2025 Budgeting Survey, over 86% of people say they budget regularly, and among them, more than 84% say it has helped them avoid or pay off debt. Budgeting works, and the numbers prove it. Isn’t it time to put your own plan in place?

How Do I Make a Budget?

Getting started with a budget is easier than you might think. Here’s a simple step-by-step process.

Step 1: Gather your financial information

Start by collecting your monthly bills, receipts, and income sources, including pay stubs, benefits, or any other money you receive regularly.

Step 2: List your monthly expenses

Break your spending into two categories:

- Fixed expenses: These stay the same each month, like rent, car payments, or internet service.

- Variable expenses: These can change from month to month, like groceries, gas, clothing, or entertainment.

Writing out all your expenses helps you get a clear picture of where your money goes and makes it easier to compare your spending to your income.

Step 3: Calculate your total monthly income

Add up your take-home pay and any additional income you receive, such as rental income, government benefits, or money from a small business. If your income varies from month to month, estimate your average by adding up your total earnings from the past year and dividing by 12 to find a monthly average.

Step 4: Subtract your expenses from your income

Now subtract your total expenses from your income.

- If the result is positive, that’s great! You have money left over to save or invest.

- If it’s negative, don’t worry. It just means it’s time to review your spending and look for areas to cut back.

How Do I Use My Budget?

A budget isn’t a one-time task. It’s a tool you should revisit and update regularly. Here’s how to put your budget into action:

- At the beginning of the month, plan how much you’ll spend in each category.

- Throughout the month, track your spending. Write it down or use a budgeting app to stay on top of it.

- At the end of the month, review how you did. Did you overspend in any areas? Did you have money left over?

- Use these insights to make adjustments for the next month. Over time, your budget will become more accurate and more useful.

Why Budgeting Matters

A good budget helps you:

- Avoid overspending and debt

- Make steady progress toward your goals

- Feel more in control of your financial future

One important part of any budget is savings. By treating savings like a regular monthly expense, you can build a cushion for the unexpected and make progress toward your goals. At Belco Community Credit Union, our savings accounts make it easy to grow your money, whether you’re preparing for an emergency, a new car, or your next vacation.

Ready to take control of your finances? Start by creating your budget today and let us help you build a savings plan that works for you. Visit your nearest branch, give us a call, or explore our savings options online. We’re here to support you every step of the way.